In recent developments, the financial sector is abuzz with discussions surrounding the Standard Chartered currency manipulation scandal. After eight years of litigation, the Competition Commission and the British multinational bank have reached a settlement, with Standard Chartered agreeing to pay a substantial amount of R42.7 million. This settlement marks the bank as the second commercial institution to admit wrongdoing in connection to the rand-dollar manipulation scandal that rocked financial markets in 2017. As the legal proceedings unfold, there is a growing chorus advocating for harsher penalties for institutions that compromise the integrity of financial markets and, subsequently, the economic well-being of nations.

1. The Standard Chartered Settlement: The heart of the matter lies in Standard Chartered’s agreement to pay a hefty settlement to the Competition Commission. This payment is a response to allegations of the bank’s involvement in the manipulation of the rand-dollar exchange rate, a scheme exposed back in 2017. The eight-year legal battle underscores the complexity and challenges associated with bringing financial institutions to account for such transgressions.

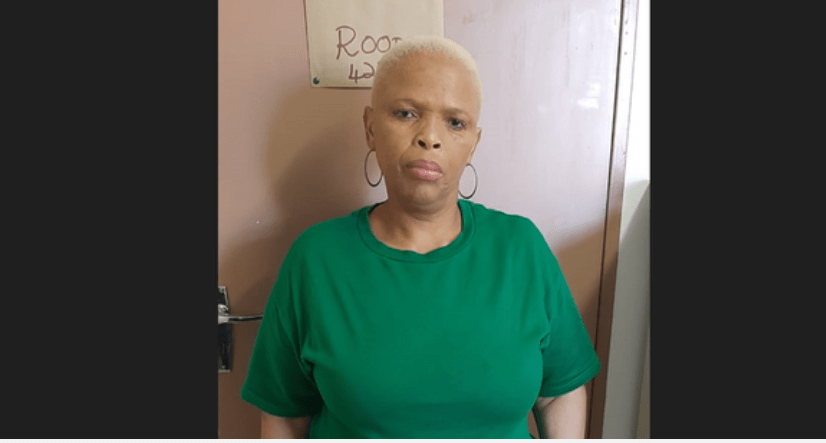

2. Impact on Financial Market Integrity: Mkhuleko Hlengwa, representing the Inkatha Freedom Party (IFP), voiced concerns over the compromise of financial market integrity. The manipulation of the South African currency, as highlighted by the Competition Commission, goes beyond mere monetary implications. It raises questions about the broader consequences on the economic well-being of nations. Such actions, if proven, not only erode trust in financial markets but also have far-reaching effects on the stability and prosperity of the affected countries.

3. Ongoing Legal Proceedings: Simultaneously, while Standard Chartered has reached a settlement, the currency rigging case is far from over. The legal drama has found its way to the Competition Appeal Court, where 28 banks, including Standard Chartered, are seeking evidence from the commission. This twist in the tale brings to light the intricate nature of proving allegations in the financial sector. The banks are requesting clarity on whether their currency traders were genuinely part of the alleged conspiracy to manipulate the rand.

4. Economic Ramifications and the IFP’s Stance: Efficient Group’s chief economist, Dawie Roodt, sheds light on the inherent difficulty in proving cases of this nature. Roodt suggests that Standard Chartered’s decision to settle may be rooted in a pragmatic approach to avoid protracted legal battles. On the other hand, other banks may be resisting settlement, recognizing the intricacies of proving innocence in such complex financial cases. The IFP’s Mkhuleko Hlengwa emphasizes the potentially detrimental effects of these actions on the economic well-being of nations, highlighting the need for stringent measures to safeguard financial markets.

5. Calls for Stricter Penalties: The unfolding Standard Chartered saga has reignited calls for institutions involved in compromising financial market integrity to face harsher penalties. Beyond financial settlements, there is a growing demand for regulatory frameworks that deter such manipulative practices and ensure accountability. The intricacies of proving these cases should not be a deterrent to holding financial institutions responsible for their actions.

As Standard Chartered settles with the Competition Commission amidst ongoing legal battles, the repercussions of the currency manipulation scandal echo through the financial sector. The case serves as a stark reminder of the challenges in maintaining the integrity of financial markets and the need for stringent penalties to deter malpractices. The ongoing legal proceedings will undoubtedly shape the future landscape of financial regulation and accountability. As the quest for justice continues, the outcomes of this case will set a precedent for addressing misconduct in the financial realm, reinforcing the importance of transparency and accountability in safeguarding economic well-being.