The recent surge in South Africa’s Consumer Price Index (CPI) has raised concerns among economists, potentially prompting the Monetary Policy Committee (MPC) of the South African Reserve Bank to consider an interest rate hike. This rise in CPI, from 4.8% in August to 5.4% in September, has brought it to the same levels as observed in June of the previous year.

Statistics South Africa has identified high fuel prices as the primary driving force behind the inflation increase. As the cost of fuel continues to climb, it has a ripple effect on various sectors of the economy, causing prices to surge. This phenomenon has captured the attention of both experts and policymakers alike, as it poses a significant challenge to maintaining economic stability.

In the last two meetings, the MPC maintained the repo rate at 8.25% due to a period of steady inflation decline. Nevertheless, it appears that they are not taking this situation lightly. The committee has issued a caution regarding inflation-related risks and has expressed its willingness to adopt a more restrictive policy and raise interest rates if deemed necessary.

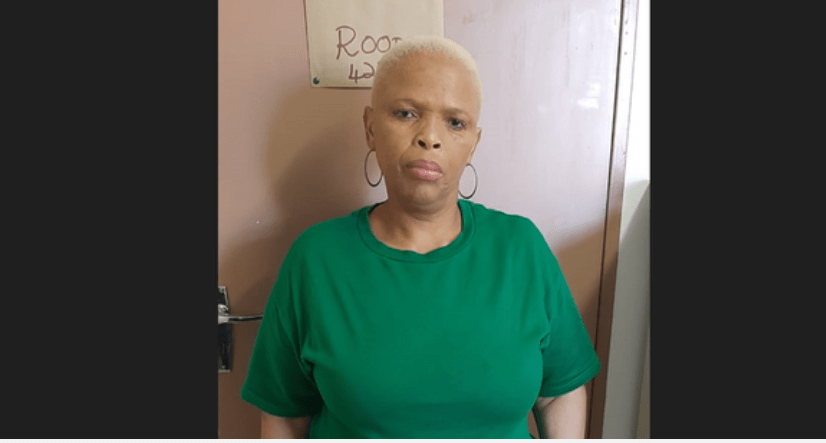

One prominent economist, Bonke Dumisa, has articulated the possible repercussions of this inflation surge. According to Dumisa, the elevated CPI indicates a likelihood of higher inflation expectations. When inflation expectations rise, the South African Reserve Bank typically responds by increasing the repo rate. This reaction is intended to curb excessive spending, which can exacerbate inflationary pressures.

Aside from the surge in fuel prices, food inflation has also played a significant role in the September CPI figures. Interestingly, these numbers follow a five-month period where the index displayed a decline. This sudden reversal raises further concerns about the overall health of the South African economy.

The relationship between the CPI and interest rates is a crucial factor in understanding the economic landscape. When the CPI rises, it signifies that the average prices of goods and services are increasing, reflecting inflation. The South African Reserve Bank’s MPC often adjusts the repo rate in response to inflationary pressures. By increasing the repo rate, they aim to reduce borrowing and spending, which, in turn, curbs inflation.

However, the decision to raise interest rates is not made lightly. Such a move can have far-reaching consequences, impacting not only borrowers but also investors, businesses, and the overall economic growth of the nation. The delicate balance between controlling inflation and fostering economic growth is the primary challenge faced by central banks worldwide.

Economists like Bonke Dumisa are closely monitoring the situation, understanding the potential consequences of a higher CPI and the subsequent interest rate hike. As the cost of living increases, citizens may experience a decline in their purchasing power, which can lead to reduced consumer spending. This, in turn, may negatively affect economic growth, as consumer spending is a critical driver of economic activity.

In conclusion, the recent surge in the Consumer Price Index, driven primarily by high fuel prices and a reversal in food inflation, has sparked concerns among economists. The South African Reserve Bank’s Monetary Policy Committee is carefully evaluating the situation, weighing the risks associated with inflation and considering the possibility of an interest rate hike. As the South African economy navigates this challenging terrain, it remains to be seen how the MPC will balance the need for inflation control with the imperative of sustaining economic growth. The coming months will reveal the decisions and policies adopted to address this critical economic issue.